Mastering The EAMS Insurance Search: A Comprehensive Guide To Finding Your Best Policy

Let’s face it, navigating the world of EAMS insurance search can feel like trying to solve a complex puzzle while blindfolded. Whether you’re a first-time policy seeker or someone looking to upgrade their existing coverage, understanding how to effectively search for EAMS insurance is crucial. It’s not just about finding a policy—it’s about securing peace of mind and financial stability. In today’s fast-paced world, having the right insurance can make all the difference when life throws unexpected curveballs your way. So, buckle up, because we’re diving deep into the ins and outs of EAMS insurance search.

You might be thinking, “Why does EAMS insurance even matter?” Great question. EAMS (Enterprise Asset Management System) insurance is specifically designed to protect businesses that rely heavily on asset management systems. These systems are the backbone of many organizations, managing everything from maintenance schedules to inventory tracking. If something goes wrong—say, a system failure or data breach—it could cost your company a pretty penny. That’s where EAMS insurance comes in, acting as your safety net.

Now, here’s the kicker: not all EAMS insurance policies are created equal. Some offer minimal coverage, while others provide comprehensive protection. The key is knowing what to look for and how to find the best policy for your needs. In this guide, we’ll break down everything you need to know about EAMS insurance search, from understanding the basics to uncovering hidden gems in the insurance market. Let’s get started!

- Is Vanna White Married Unveiling The Personal Life Of A Tv Icon

- Sophie Rain Mega Folder The Ultimate Guide To Unlocking Digital Treasure

What Exactly is EAMS Insurance?

Alright, let’s clear the air. EAMS insurance isn’t your run-of-the-mill car or health insurance. This type of coverage is tailored specifically for businesses that depend on enterprise asset management systems. Think of it like a shield for your company’s most valuable assets. EAMS insurance typically covers things like:

- System failures

- Data breaches

- Unplanned downtime

- Equipment damage

But here’s the thing: every policy has its own set of rules and limitations. Some might cover only specific types of failures, while others offer broader protection. It’s important to read the fine print and understand exactly what you’re getting into. Don’t let fancy jargon confuse you—ask questions and clarify any doubts before signing on the dotted line.

Why EAMS Insurance Search Matters

Imagine this: your company’s EAMS goes down unexpectedly. Orders are delayed, maintenance schedules are disrupted, and productivity takes a nosedive. Without proper insurance, you could be looking at a hefty bill to fix the issue and recover lost revenue. That’s why EAMS insurance search is so critical. By finding the right policy, you can:

- Cole Hauser And Reba Mcentire Relationship The Inside Scoop Youve Been Waiting For

- Pansy Parkinson Harry Potter A Deep Dive Into Her Character And Influence

- Minimize financial risks

- Protect your business assets

- Ensure smooth operations

- Gain peace of mind

But here’s the catch: with so many options out there, it can be overwhelming to choose the best one. That’s where this guide comes in—to simplify the process and help you make an informed decision.

Key Factors to Consider in Your EAMS Insurance Search

When it comes to EAMS insurance search, there are a few key factors you need to keep in mind. These will help you narrow down your options and find a policy that fits your business like a glove. Here’s what you should consider:

1. Coverage Scope

Not all EAMS insurance policies offer the same level of coverage. Some might focus solely on system failures, while others include data breaches and equipment damage. Make sure the policy you choose covers all the potential risks your business faces.

2. Deductibles and Premiums

Deductibles and premiums are two important factors that affect the cost of your insurance. A higher deductible might lower your premium, but it means you’ll have to pay more out of pocket if something happens. On the other hand, a lower deductible might increase your premium but provide more immediate coverage.

3. Reputation of the Insurer

Don’t just go with the first insurer you find. Do your homework and research their reputation. Look for reviews, ratings, and testimonials from other businesses. A trustworthy insurer will be there for you when you need them most.

How to Conduct an Effective EAMS Insurance Search

Now that you know what to look for, let’s talk about how to conduct an effective EAMS insurance search. Here’s a step-by-step guide to help you find the best policy for your business:

Step 1: Assess Your Needs

Before you start searching, take some time to assess your business’s specific needs. What assets do you rely on most? What potential risks could impact your operations? Understanding your unique requirements will help you identify the right policy.

Step 2: Research Insurers

Once you know what you need, start researching insurers. Look for companies that specialize in EAMS insurance and have a solid track record. Check their website, read customer reviews, and compare their offerings.

Step 3: Compare Policies

Don’t settle for the first policy you find. Take the time to compare multiple options. Look at the coverage details, premiums, deductibles, and any additional features. Make a list of pros and cons for each policy to help you make an informed decision.

Common Mistakes to Avoid in EAMS Insurance Search

Even the savviest business owners can make mistakes during their EAMS insurance search. Here are some common pitfalls to avoid:

- Underestimating your coverage needs

- Choosing a policy based solely on price

- Ignoring the fine print

- Not shopping around for the best deal

Remember, the goal is to find a policy that offers the right balance of coverage and cost. Don’t let these mistakes cost you in the long run.

Understanding the Costs of EAMS Insurance

EAMS insurance can vary significantly in cost depending on several factors. These include the size of your business, the complexity of your asset management system, and the level of coverage you need. While it’s tempting to go for the cheapest option, it’s important to weigh the costs against the benefits. A more expensive policy might offer better protection, saving you money in the long run.

Breaking Down the Costs

To give you a better idea, here’s a breakdown of the typical costs associated with EAMS insurance:

- Basic coverage: $500–$1,000 per year

- Mid-tier coverage: $1,500–$3,000 per year

- Premium coverage: $3,500+ per year

Keep in mind that these are just estimates. The actual cost will depend on your specific business needs and the insurer you choose.

Tips for Maximizing Your EAMS Insurance Coverage

Once you’ve found the right EAMS insurance policy, it’s important to make the most of it. Here are some tips to help you maximize your coverage:

- Regularly review your policy to ensure it still meets your needs

- Take advantage of any additional features or discounts offered by your insurer

- Document everything related to your EAMS system, including maintenance records and software updates

- Stay informed about industry trends and potential risks

By following these tips, you can ensure your EAMS insurance provides the protection your business needs.

Real-Life Examples of EAMS Insurance in Action

Let’s take a look at some real-life examples of how EAMS insurance has helped businesses in similar situations. These stories illustrate the importance of having the right coverage:

Example 1: The System Failure

A manufacturing company experienced a sudden system failure that halted production for two days. Thanks to their EAMS insurance, they were able to cover the costs of repairs and compensate for lost revenue.

Example 2: The Data Breach

A logistics firm fell victim to a data breach, compromising sensitive customer information. Their EAMS insurance covered the costs of investigations, legal fees, and customer notifications, saving them from financial ruin.

These examples show just how vital EAMS insurance can be in protecting your business from unexpected setbacks.

Future Trends in EAMS Insurance

The world of EAMS insurance is constantly evolving. As technology advances and new risks emerge, insurers are adapting their policies to meet changing demands. Here are some trends to watch out for:

- Increased focus on cybersecurity

- More personalized coverage options

- Integration with IoT and AI systems

Staying ahead of these trends can help you make the most of your EAMS insurance and ensure your business is prepared for whatever the future holds.

Conclusion: Taking the First Step in Your EAMS Insurance Search

Now that you’ve made it to the end of this guide, you should have a solid understanding of EAMS insurance search and how it can benefit your business. Remember, finding the right policy is all about knowing your needs, researching your options, and making an informed decision. Don’t rush the process—take the time to find a policy that offers the coverage and protection your business deserves.

So, what’s next? We encourage you to take action by starting your EAMS insurance search today. Whether you’re reaching out to insurers, comparing policies, or gathering more information, every step you take brings you closer to securing your business’s future. And don’t forget to share this guide with your colleagues and friends—knowledge is power, and together we can make the world of EAMS insurance a little less daunting.

Table of Contents

- What Exactly is EAMS Insurance?

- Why EAMS Insurance Search Matters

- Key Factors to Consider in Your EAMS Insurance Search

- How to Conduct an Effective EAMS Insurance Search

- Common Mistakes to Avoid in EAMS Insurance Search

- Understanding the Costs of EAMS Insurance

- Tips for Maximizing Your EAMS Insurance Coverage

- Real-Life Examples of EAMS Insurance in Action

- Future Trends in EAMS Insurance

- Conclusion: Taking the First Step in Your EAMS Insurance Search

- How To Balance Your Vanilla Gift Card A Comprehensive Guide

- John Roberts Fox News Illness The Inside Story You Need To Know

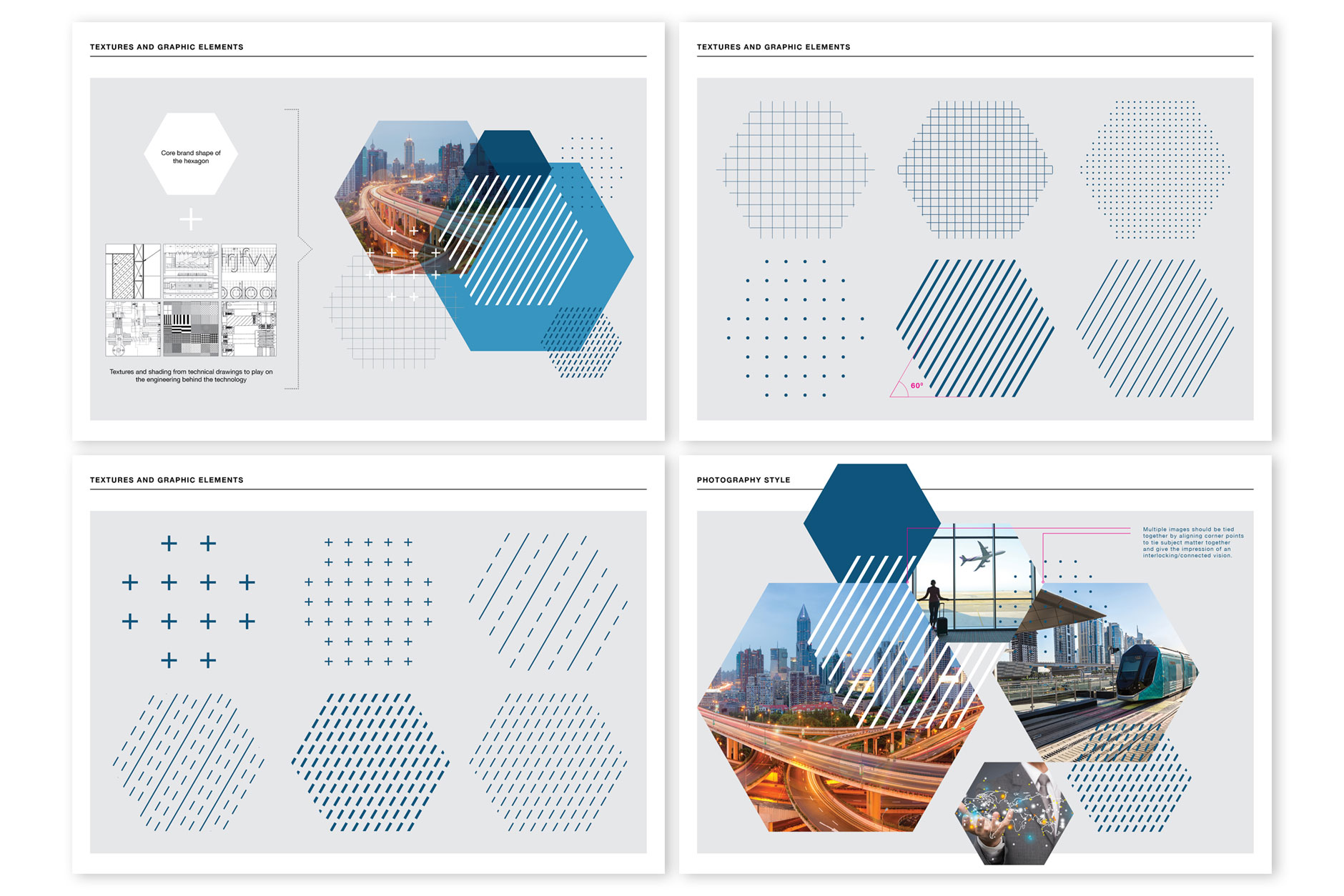

Limited Edition Design EAMS Group branding by LimitedEditionDesign

Energy Asset Management Service EnergyFlex

Top Global Summit Life Insurance Agency