Conns Payments: A Comprehensive Guide To Simplify Your Financial Journey

So, here's the deal. Conns payments have become a hot topic in the financial world, and if you're reading this, chances are you're either curious about what they are or already knee-deep in the process. Let me break it down for you. Conns payments are more than just numbers on a screen. They represent a system designed to help consumers manage their finances with ease, flexibility, and transparency. In this chaotic world of loans, credit cards, and installment plans, Conns stands out as a player worth knowing about.

Now, before we dive deep into the nitty-gritty, let's get one thing straight. Conns isn't just another financial service provider. It's a company that specializes in offering retail credit solutions, specifically tailored for customers who might not have access to traditional banking options. Think of it like a lifeline for people looking to furnish their homes or buy essential items without breaking the bank immediately.

And here's why this matters to you. Whether you're considering a Conns payment plan for your next big purchase or just trying to understand how it works, this article will walk you through everything you need to know. We'll cover the basics, explore the benefits, discuss potential drawbacks, and even throw in some expert tips to help you make the most of it. So, buckle up, because we're about to take a deep dive into the world of Conns payments!

- Martha Stewart Presidential Endorsement The Power Of Influence In Politics

- How Old Is Mgk A Deep Dive Into Machine Gun Kellys Life And Legacy

Table of Contents:

- What Are Conns Payments?

- Benefits of Using Conns

- How Conns Works

- Eligibility Requirements

- Conns Credit Card

- Managing Your Accounts

- Common Questions

- Conns vs. Other Providers

- Potential Drawbacks

- Tips for Success

What Are Conns Payments?

Alright, let's start with the basics. Conns payments refer to a payment system offered by Conns, a company that specializes in providing credit solutions for retail purchases. It's like having a personal finance assistant that lets you pay for big-ticket items over time instead of all at once. This makes it easier for people to manage their expenses without feeling the immediate financial strain.

Conns payments are typically associated with furniture, appliances, and electronics. You know, those items that make your home feel like home. The idea is simple: you buy now and pay later, but with a structured plan that fits your budget. It's not just about buying stuff; it's about creating a financial plan that works for you.

- Nyt Connections Hints November 29 Your Ultimate Guide To Mastering The Puzzle

- Maplestar Nobara And Yuji A Deep Dive Into Their World

How Conns Payments Help Consumers

Let's talk about how Conns payments can actually help you. For starters, they provide an alternative to traditional credit options, which can be tough to get if you don't have a stellar credit score. Conns focuses on making credit accessible to everyone, regardless of their financial history. Plus, their payment plans are flexible, meaning you can choose terms that suit your financial situation.

Another cool thing about Conns is the transparency. They clearly outline the terms and conditions, so there are no hidden surprises. You know exactly what you're signing up for, which gives you peace of mind. And let's be honest, who doesn't love a little clarity when it comes to money matters?

Benefits of Using Conns

Now that we've covered the basics, let's dive into the benefits of using Conns payments. First and foremost, Conns offers a convenient way to purchase essential items without having to pay the full amount upfront. This is a game-changer for many people who might not have the cash on hand but still need to furnish their homes or upgrade their appliances.

Another big plus is the flexibility in payment options. Conns allows you to choose from various payment plans, giving you the freedom to tailor your payments to your budget. Whether you prefer shorter terms with higher payments or longer terms with lower payments, Conns has got you covered.

Improved Credit Score

Did you know that using Conns payments can actually help improve your credit score? By making regular, on-time payments, you demonstrate financial responsibility, which is a key factor in building a good credit history. Over time, this can lead to better credit scores, opening up more financial opportunities for you in the future.

And here's the cherry on top: Conns reports your payment activity to credit bureaus. So, every time you make a payment, it's like you're giving your credit score a little boost. It's a win-win situation, really.

How Conns Works

So, how exactly does Conns work? Well, it's pretty straightforward. First, you visit a retailer that partners with Conns. These could be furniture stores, appliance dealers, or electronics retailers. Once you find the item you want to purchase, you apply for a Conns credit account. The application process is quick and easy, and you'll usually get an answer within minutes.

If your application is approved, you can complete your purchase and start your payment plan. Conns offers different payment options, including fixed monthly payments or interest-free promotions for a limited time. You choose the plan that works best for you, and that's pretty much it. Simple, right?

Key Features of Conns Payment Plans

Here are some key features of Conns payment plans that you should know about:

- Flexible payment terms

- No hidden fees

- Interest-free promotions

- Transparent terms and conditions

- Convenient online account management

These features make Conns a popular choice for many consumers looking for a reliable and user-friendly payment solution.

Eligibility Requirements

Of course, there are some eligibility requirements you need to meet to qualify for a Conns payment plan. While Conns is known for being more lenient than traditional lenders, they still have certain criteria to ensure borrowers can manage their payments responsibly.

Typically, you'll need to be at least 18 years old, have a valid Social Security number, and provide proof of income. Conns also considers your credit history, but they're more forgiving than other lenders, which is great news for those with less-than-perfect credit scores.

Tips for Increasing Your Chances of Approval

Here are a few tips to increase your chances of getting approved for a Conns payment plan:

- Ensure your income is stable and consistent

- Provide accurate and up-to-date information on your application

- Check your credit report for any errors and get them corrected

- Be honest about your financial situation

Following these tips can improve your odds of getting approved and help you secure a payment plan that suits your needs.

Conns Credit Card

Conns also offers a credit card, which can be a useful tool for managing your finances. The Conns credit card works similarly to other credit cards, but with some unique features that set it apart. For one, it's specifically designed for retail purchases, making it ideal for buying furniture, appliances, and electronics.

Another advantage of the Conns credit card is the rewards program. By using the card for eligible purchases, you can earn rewards that can be redeemed for future purchases. It's like getting a little something back for being a loyal customer.

Using the Conns Credit Card Responsibly

Using the Conns credit card responsibly is key to avoiding debt and maintaining a good credit score. Here are a few tips to help you use your card wisely:

- Only charge what you can afford to pay back

- Make payments on time every month

- Monitor your credit card statements regularly

- Take advantage of interest-free promotions when available

By following these tips, you can enjoy the benefits of the Conns credit card without worrying about getting into financial trouble.

Managing Your Accounts

Managing your Conns account is easier than ever with their online platform. You can log in to your account anytime to view your payment history, update your personal information, and even make payments. It's all done in one convenient place, which makes managing your finances a breeze.

Another cool feature is the ability to set up automatic payments. This ensures you never miss a payment, which is crucial for maintaining a good credit score. Plus, you can receive email notifications and alerts to keep you informed about your account activity.

Account Management Tips

Here are some tips to help you manage your Conns account effectively:

- Set up automatic payments to avoid late fees

- Regularly review your account statements for accuracy

- Utilize the Conns app for on-the-go access

- Contact customer service promptly if you have any questions or issues

By staying on top of your account management, you can ensure a smooth and hassle-free experience with Conns.

Common Questions

Let's address some common questions people have about Conns payments:

Q: Can I use Conns payments for any purchase?

A: Conns payments are typically available for purchases at partner retailers, which usually include furniture, appliances, and electronics.

Q: What happens if I miss a payment?

A: If you miss a payment, you may incur late fees, and it could negatively impact your credit score. It's important to make payments on time to avoid these consequences.

Q: Can I pay off my balance early?

A: Yes, you can pay off your balance early without any prepayment penalties. In fact, paying early can save you money on interest and improve your credit score.

Conns vs. Other Providers

When it comes to choosing a payment solution, it's important to compare Conns with other providers. While Conns offers many advantages, such as flexible payment terms and transparent pricing, other providers may have different features that could be more suitable for your needs.

For example, some providers may offer lower interest rates or more extensive rewards programs. It's all about finding the right fit for your financial situation and preferences.

Why Choose Conns?

Here are a few reasons why you might choose Conns over other providers:

- Conns specializes in retail credit solutions

- They offer flexible payment options

- They report to credit bureaus, helping you build credit

- Their online platform makes account management easy

These factors make Conns a strong contender in the world of payment solutions.

Potential Drawbacks

While Conns offers many benefits, there are a few potential drawbacks to consider. For one, the interest rates can be higher than traditional credit options, especially if you don't qualify for promotional rates. This means you could end up paying more over time if you don't pay off your balance quickly.

Additionally, Conns primarily serves customers who might have limited access to traditional credit. While this is a positive for many people, it also means they may not have the same level of credit limits or rewards as other providers.

How to Minimize Risks

Here are some tips to help you minimize risks when using Conns payments:

- Only purchase items within your budget

- Take advantage of interest-free promotions when available

- Make payments on time every month

- Monitor your credit score regularly

By following these tips, you can enjoy the benefits of Conns payments while minimizing potential risks.

Tips for Success

Finally, here are some general tips for success when using Conns payments:

- Set a budget and stick to it

- Shop around for the best deals before making a purchase

- Read the terms and conditions carefully before signing up

- Use the Conns app to stay on top of your account activity

- Young Paradise Login And Password A Beginners Guide To Unlocking Your Digital Paradise

- Kordell Beckham Height The Rising Star Taking The World By Storm

Hisense Conn's

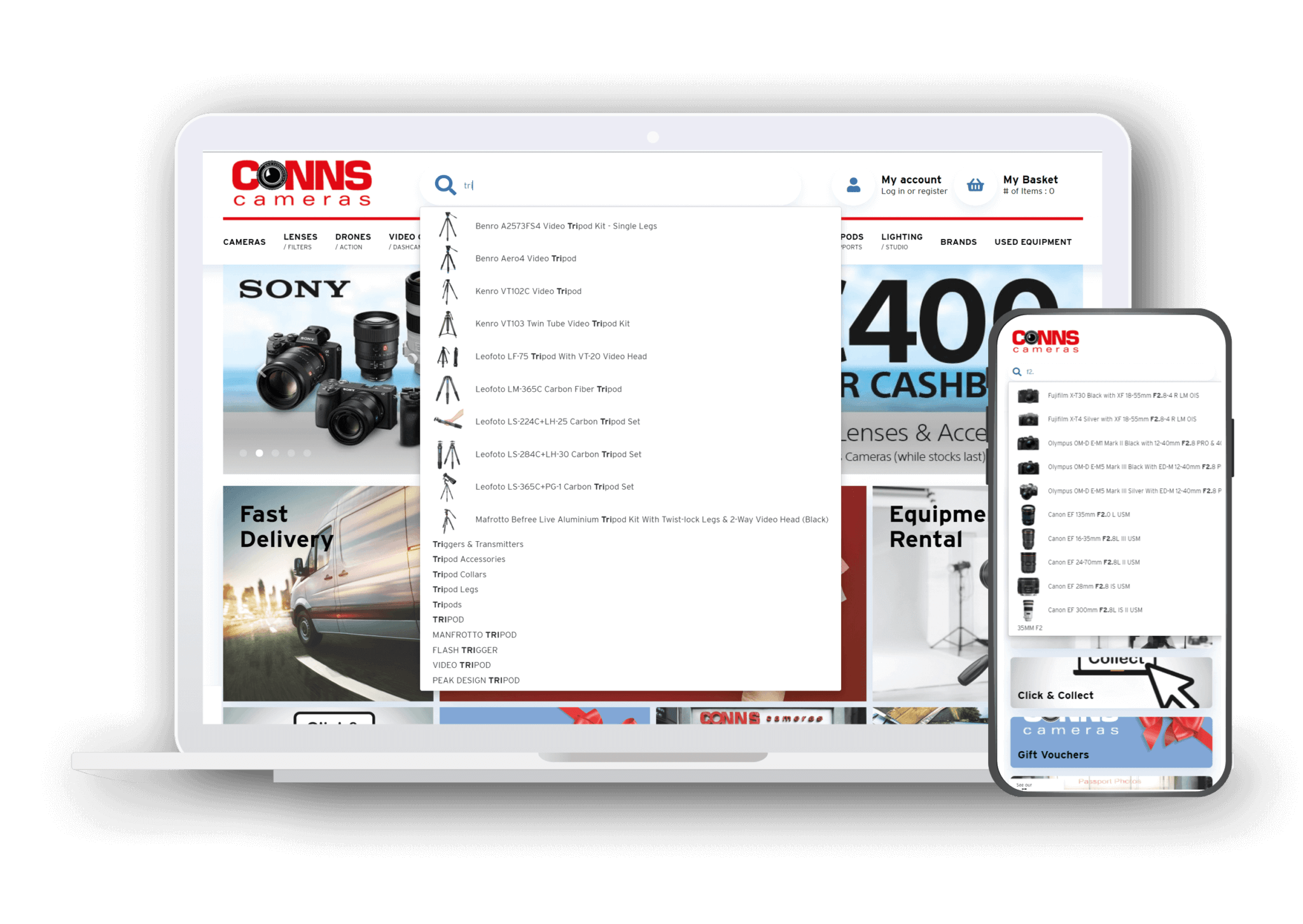

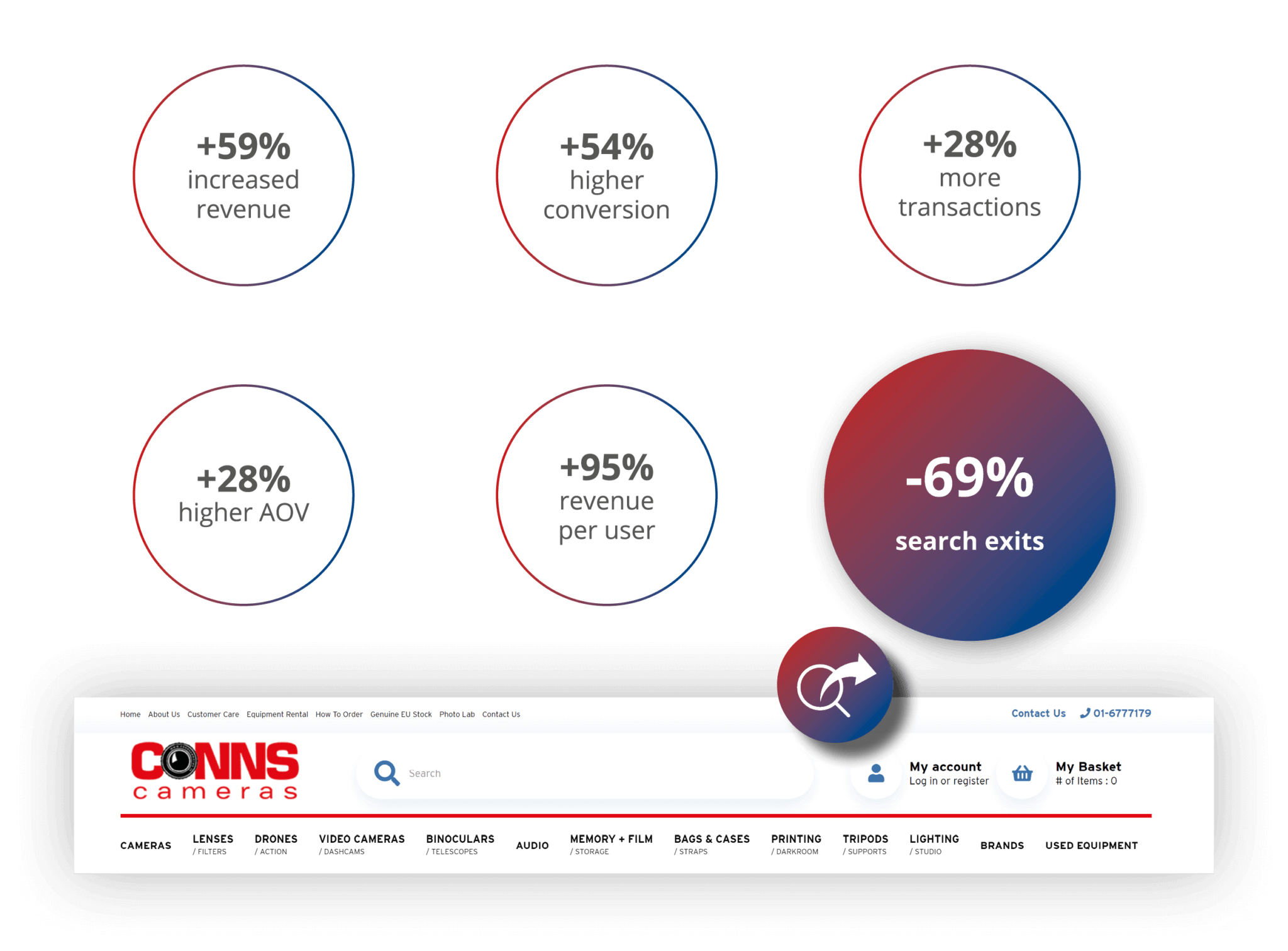

Conns Cameras Makes Finding Complicated Product Names Simple With

Conns Cameras Makes Finding Complicated Product Names Simple With