How To Order Checks From Chase: A Comprehensive Guide For Easy Banking

Ordering checks from Chase might sound like a hassle, but trust me, it’s easier than you think. Whether you're a first-timer or someone who hasn’t ordered checks in years, this guide will walk you through every step like a pro. Let’s face it—checks are still relevant for certain payments, and having them handy can save you from awkward moments. So, buckle up and let’s dive into the world of Chase checks!

Nowadays, people are all about digital payments, but there’s something comforting about having a physical checkbook. Maybe you need it for rent, utility bills, or even that rare occasion where someone asks for a check instead of cash. Whatever the reason, Chase makes it super simple to order checks without losing your mind.

In this article, we’ll cover everything from the basics of ordering checks to advanced tips that’ll make you feel like a banking wizard. Stick around, and by the end of it, you’ll know exactly how to get those checks rolling without breaking a sweat.

- Ginny Amp Georgia Cast The Ultimate Guide To Your Favorite Netflix Series

- Jojo Horton Hears A Who A Whovian Adventure Thatrsquos Out Of This World

Why Order Checks from Chase?

Let’s start with the basics. Chase is one of the biggest banks in the U.S., and they’ve got your back when it comes to financial needs. Ordering checks from Chase ensures you’re dealing with a trusted institution that prioritizes security and convenience. Plus, their customer service is top-notch if you run into any hiccups along the way.

But why Chase, you ask? Well, Chase offers customizable options, so you can design your checks to match your style. From choosing colors to adding personal messages, the possibilities are endless. And hey, who doesn’t love a bit of personalization?

Benefits of Using Chase Checks

Here’s a quick rundown of why Chase checks are worth the effort:

- Harmonicode The Revolutionary Way To Unlock Your Inner Harmony

- 59 Million Unpacking The Dannielynn Birkhead Net Worth Saga

- Highly secure with fraud protection

- Customizable designs to suit your taste

- Easy-to-use ordering process

- Reliable delivery straight to your doorstep

And let’s not forget the peace of mind that comes with knowing your checks are backed by one of the most reputable banks in the country.

How to Order Checks from Chase Online

Let’s get down to business. Ordering checks online is hands down the easiest way to go. Here’s how you can do it in just a few steps:

Step 1: Log In to Your Chase Account

First things first, head over to the Chase website or open their mobile app. Log in using your credentials. If you haven’t set up an online account yet, now’s the perfect time to do it. Don’t worry—it’s quick and painless.

Step 2: Navigate to the Check Ordering Section

Once you’re logged in, look for the “Order Checks” option. It’s usually under the “Accounts” or “Services” tab. Click on it, and you’ll be taken to the ordering page.

Step 3: Customize Your Checks

This is where the fun begins. You can choose from a variety of designs, add your name and address, and even include a personal message if you want. Chase offers tons of options, so take your time to pick something that suits your vibe.

Step 4: Confirm Your Order

After customizing your checks, double-check everything to make sure it’s accurate. Once you’re satisfied, hit “Confirm” and voilà! Your order is on its way.

Pro tip: Keep an eye on your email for order updates and tracking information.

How to Order Checks from Chase via Phone

Not a fan of online ordering? No worries. You can always order checks by calling Chase customer service. Here’s what you need to do:

Step 1: Find the Customer Service Number

The Chase customer service number is usually listed on the back of your debit card or on their website. Give them a call during business hours to ensure someone’s available to assist you.

Step 2: Provide Your Account Information

When you speak to a representative, they’ll ask for some basic info to verify your identity. This might include your account number, Social Security number, or the last four digits of your debit card.

Step 3: Choose Your Check Design

Just like online ordering, you can choose from a variety of designs over the phone. The representative will guide you through the options and help you make the best choice.

Step 4: Confirm Your Order

Once you’ve made your selections, confirm your order with the representative. They’ll provide you with an order number for future reference.

Easy peasy, right?

How Long Does It Take to Receive Your Checks?

Now that you’ve placed your order, you’re probably wondering how long it’ll take for your checks to arrive. Typically, Chase checks take around 7-10 business days to be delivered. However, this timeline can vary depending on your location and the shipping method you choose.

If you need your checks sooner, Chase offers expedited shipping for an additional fee. Just keep in mind that rush orders may take 3-5 business days instead.

What Happens If Your Checks Don’t Arrive on Time?

Life happens, and sometimes orders get delayed. If your checks don’t arrive within the estimated timeframe, don’t panic. Contact Chase customer service and provide them with your order number. They’ll track your package and let you know what’s going on.

Common Mistakes to Avoid When Ordering Checks

Ordering checks might seem straightforward, but there are a few pitfalls to watch out for. Here are some common mistakes and how to avoid them:

- Forgetting to double-check your personal information

- Not selecting a secure design to prevent fraud

- Overlooking shipping options and timelines

- Not keeping a record of your order number

By staying vigilant and paying attention to these details, you can ensure a smooth ordering process.

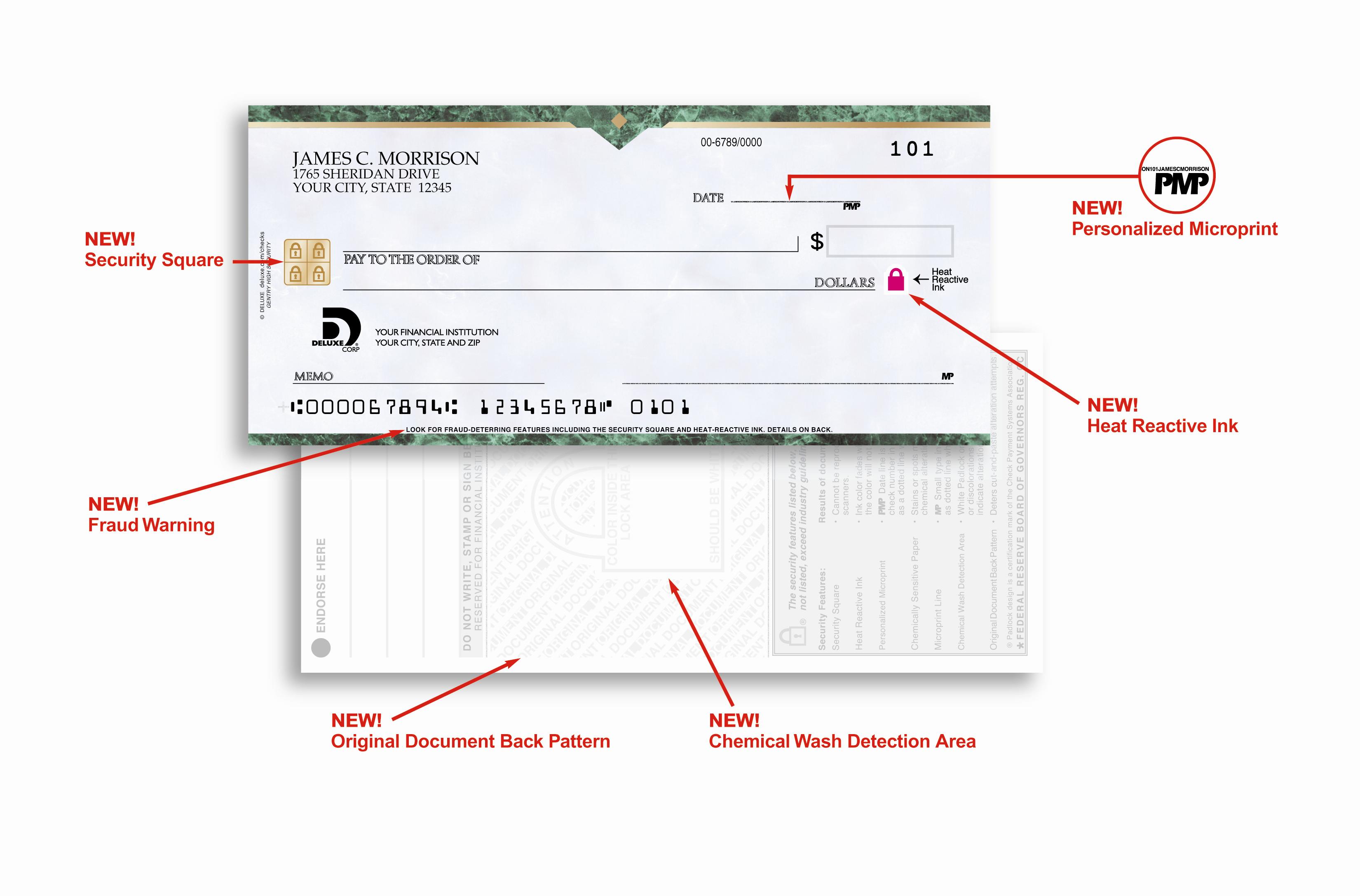

Tips for Securing Your Chase Checks

Security is key when it comes to checks. Here are some tips to keep your checks safe:

Tip 1: Store Them in a Secure Location

Once your checks arrive, keep them in a locked drawer or safe place. You never know when someone might try to sneak a peek.

Tip 2: Use a Pen with Tamper-Proof Ink

When writing checks, always use a pen with tamper-proof ink. This makes it harder for fraudsters to alter the information.

Tip 3: Monitor Your Account Regularly

Keep an eye on your Chase account for any suspicious activity. If you notice anything unusual, report it to Chase immediately.

Costs Associated with Ordering Checks from Chase

Let’s talk money. Ordering checks from Chase isn’t free, but the costs are pretty reasonable. Prices vary depending on the quantity and design you choose. On average, a book of 150 checks can cost anywhere from $15 to $30.

If you’re on a tight budget, consider ordering fewer checks or opting for a simpler design. Chase also offers discounts for bulk orders, so it might be worth stocking up if you write checks frequently.

Alternatives to Ordering Checks from Chase

While Chase is a great option, there are other ways to order checks. Here are a few alternatives:

Option 1: Third-Party Check Printing Services

Companies like Checks Unlimited and Deluxe offer competitive prices and a wide range of designs. Just make sure they’re FDIC-approved to ensure security.

Option 2: DIY Check Printing

If you’re feeling adventurous, you can print your own checks at home. However, this requires special check paper and software, so it might not be the most cost-effective solution.

FAQs About Ordering Checks from Chase

Got questions? We’ve got answers. Here are some frequently asked questions about ordering checks from Chase:

Q1: Can I order checks if I don’t have a checking account?

Nope. You’ll need an active checking account with Chase to order checks. If you don’t have one, consider opening a new account or using a different method of payment.

Q2: What happens if I lose my checks?

If you lose your checks, contact Chase immediately to cancel the order and reorder new ones. They’ll guide you through the process and help you stay protected.

Q3: Can I reorder checks if I run out?

Absolutely! Just follow the same steps you used to place your initial order. Chase makes it super easy to reorder whenever you need more checks.

Conclusion: Take Action Today!

Ordering checks from Chase doesn’t have to be a headache. With their user-friendly platform and excellent customer service, you can get your checks in no time. Remember to customize your design, keep track of your order, and prioritize security.

So, what are you waiting for? Head over to Chase and place your order today. And don’t forget to share this article with your friends who might need a helping hand. Together, let’s make banking a breeze!

Table of Contents

- Why Order Checks from Chase?

- How to Order Checks from Chase Online

- How to Order Checks from Chase via Phone

- How Long Does It Take to Receive Your Checks?

- Common Mistakes to Avoid When Ordering Checks

- Tips for Securing Your Chase Checks

- Costs Associated with Ordering Checks from Chase

- Alternatives to Ordering Checks from Chase

- FAQs About Ordering Checks from Chase

- Conclusion: Take Action Today!

- Addams Family Morticia The Iconic Matriarch Who Stole Our Hearts

- Why The Arcyart Artist Directory Is Your Ultimate Creative Companion

How To Order Checks From Chase (Order Your Checks) GOBankingRates

How To Order Chase Checks ASAP GOBankingRates

How To Order Checks From Chase Bank A Comprehensive Guide