Discover Your Hidden Treasure: State Of Wisconsin Unclaimed Funds

Alright, listen up folks. Let’s talk about something that might just change your life—or at least put some extra cash in your pocket. Are you aware of the state of Wisconsin unclaimed funds? No, this isn’t some get-rich-quick scheme or a scam email from a Nigerian prince. This is real money, sitting there waiting for you to claim it. People often forget about old bank accounts, insurance policies, or even tax refunds, and guess what? The state holds onto that cash until you come knocking. So, are you ready to find out if there’s a little (or maybe a lot) of unclaimed treasure with your name on it?

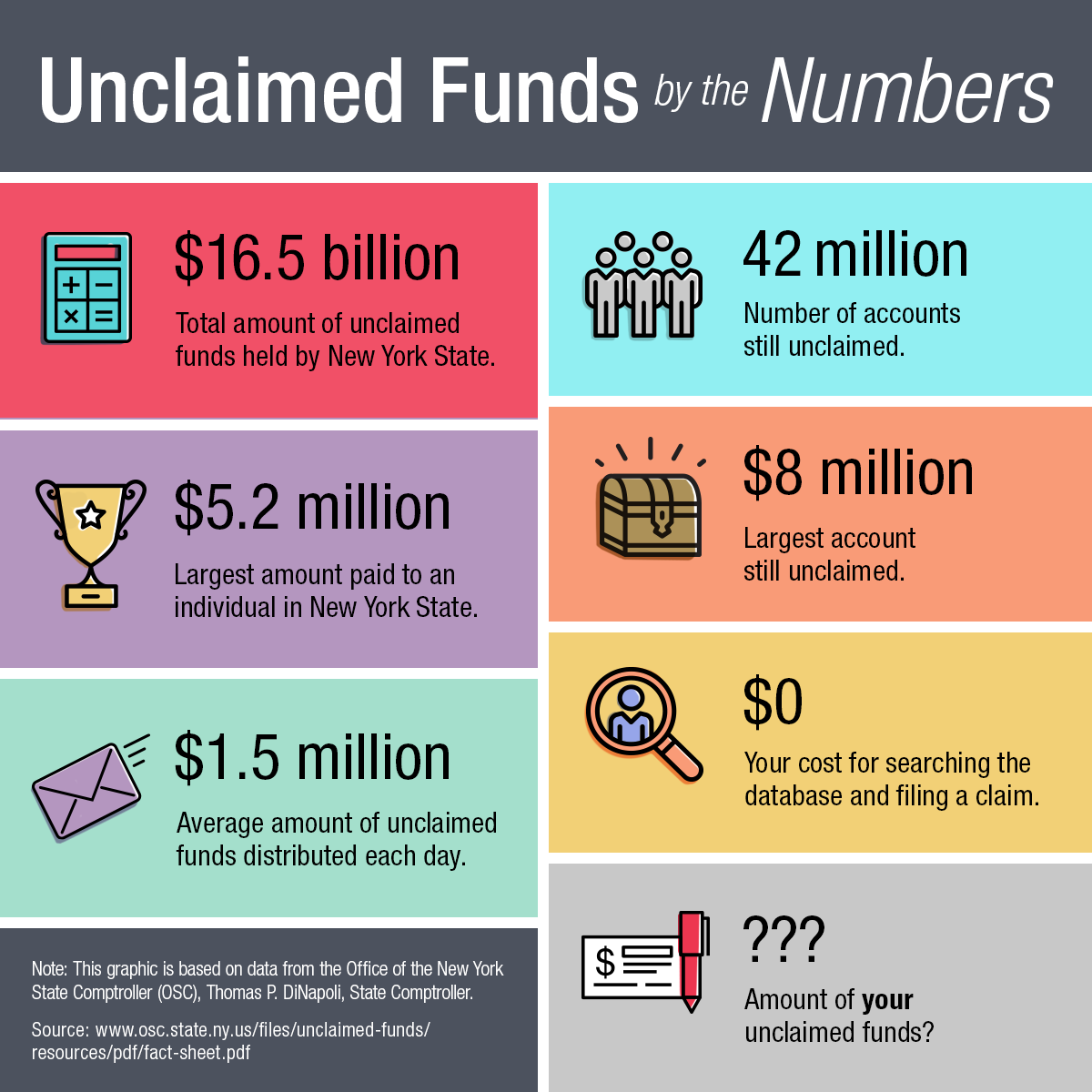

Now, before we dive into the nitty-gritty details, let me tell you why this matters. Every year, millions of dollars go unclaimed across the United States. In Wisconsin alone, the amount of unclaimed funds can be staggering. Whether it’s a forgotten utility deposit, an old savings account, or even a lost stock certificate, these funds are out there, and they belong to someone—possibly YOU. So, don’t just sit there scrolling through your social media feed. Let’s get to work!

But here’s the thing: finding and claiming your unclaimed funds doesn’t have to be complicated. In fact, it’s surprisingly simple if you know where to look and how to navigate the system. That’s exactly what we’re going to cover in this article. From understanding what unclaimed funds are to actually getting your hands on that money, we’ve got you covered. So grab a coffee, sit back, and let’s unravel the mystery of the state of Wisconsin unclaimed funds.

- Love And Hip Hop Atlanta Cast The Ultimate Guide To The Stars

- Kristen Seeman The Rising Star You Need To Know About

What Exactly Are Unclaimed Funds?

First things first, let’s break down what we’re talking about here. Unclaimed funds refer to money or assets that have been left behind by individuals or businesses for various reasons. It could be anything from forgotten bank accounts, uncashed checks, life insurance payouts, or even utility deposits. When these funds are inactive for a certain period, they’re transferred to the state, which acts as a custodian until the rightful owner comes forward to claim them. In Wisconsin, this process is overseen by the Wisconsin Department of Revenue, and they’ve got a pretty robust system in place to help people track down their lost money.

How Do Funds Become Unclaimed?

There are several ways funds can end up in the unclaimed category. Sometimes, people move and forget to update their address with their bank or financial institution. Other times, they simply lose track of old accounts or forget about them altogether. It’s not uncommon for people to pass away without informing their beneficiaries about certain assets, leaving those funds to sit untouched. Whatever the reason, once the account has been inactive for a certain period—usually three to five years—it gets handed over to the state.

Why Should You Care About Unclaimed Funds?

Here’s the kicker: this money is legally yours. The state isn’t keeping it; they’re holding it for you until you decide to claim it. Think about it—wouldn’t it be nice to discover a few hundred (or even a few thousand) dollars sitting in an account you didn’t even know existed? This isn’t just about finding loose change in the couch cushions; this is about reclaiming assets that rightfully belong to you. Plus, it’s free money! Who doesn’t love that?

- Unveiling Damian Musk The Rising Star In The Tech World

- Unveiling The Usher Age A New Era Of Innovation And Transformation

Why Wisconsin Stands Out in the World of Unclaimed Funds

Wisconsin has earned a reputation for being particularly diligent when it comes to managing unclaimed funds. The state has invested in technology and resources to make the process as smooth as possible for residents. They’ve created a user-friendly database where anyone can search for their name and see if there’s any money waiting for them. Plus, Wisconsin regularly runs public awareness campaigns to ensure that people know about the existence of unclaimed funds and how to claim them.

The Size of the Problem

Let’s talk numbers for a second. According to recent estimates, the state of Wisconsin holds over $1.2 billion in unclaimed funds. That’s right—billion with a “B.” And here’s the kicker: a significant portion of that money belongs to everyday people who simply haven’t bothered to check if they’re owed anything. Imagine if just a fraction of that amount was returned to its rightful owners. It could make a real difference in people’s lives, whether it’s paying off debt, funding a vacation, or even starting a small business.

How Wisconsin Handles Unclaimed Funds

Wisconsin follows a strict protocol when it comes to managing unclaimed funds. Once an account has been inactive for a set period, the financial institution is required by law to report it to the state. From there, the state takes over and holds onto the funds indefinitely. Unlike some other states, Wisconsin doesn’t impose a time limit on how long you have to claim your money. As long as you can prove you’re the rightful owner, you can reclaim your funds anytime.

How to Search for Unclaimed Funds in Wisconsin

Now that you understand what unclaimed funds are and why they matter, let’s talk about how to actually find out if there’s money waiting for you. The process is surprisingly straightforward, but there are a few steps you’ll need to follow. Here’s a quick guide:

- Visit the official Wisconsin Unclaimed Property website.

- Enter your name (or the name of a deceased relative) into the search bar.

- Review the results to see if any matches come up.

- If you find a match, follow the instructions to file a claim.

It’s important to note that you don’t have to pay anyone to search for or claim your unclaimed funds. There are plenty of websites and companies out there offering to do the legwork for you—for a fee, of course—but trust me, it’s not necessary. The state provides all the tools you need to do it yourself, and it’s completely free.

Tips for a Successful Search

Here are a few tips to help you maximize your chances of finding unclaimed funds:

- Search using variations of your name, including maiden names or nicknames.

- Include all possible addresses you’ve lived at in the past.

- Check for deceased relatives who might have left behind unclaimed assets.

- Double-check the spelling of your name and other details to avoid missing potential matches.

Common Types of Unclaimed Funds in Wisconsin

So, what kind of money are we talking about here? Unclaimed funds come in all shapes and sizes, but here are some of the most common types you might encounter:

Bank Accounts

Forgotten savings or checking accounts are one of the biggest categories of unclaimed funds. If you’ve ever had an account that you stopped using, chances are it’s been reported to the state. Even small balances can add up over time, so it’s worth checking.

Insurance Policies

Life insurance policies are another common source of unclaimed funds. Sometimes, beneficiaries aren’t aware that a policy exists, or they don’t know how to claim the payout. The state can help connect you with the insurance company to ensure you receive what’s owed to you.

Stocks and Bonds

Old stock certificates or bonds can also end up in the unclaimed category. If you’ve ever invested in a company and lost track of your holdings, it’s worth checking to see if the state has them on file.

How to Claim Your Unclaimed Funds

Once you’ve identified potential matches in the unclaimed funds database, it’s time to file a claim. Here’s how to do it:

First, gather all the necessary documentation. This typically includes proof of identity (like a driver’s license or passport) and proof of address (such as a utility bill or lease agreement). If you’re claiming funds on behalf of a deceased relative, you’ll also need to provide a copy of the death certificate and any other relevant paperwork.

Next, fill out the claim form provided by the state. This can usually be done online, but in some cases, you may need to submit a paper form by mail. Make sure to fill out the form completely and accurately to avoid delays in processing.

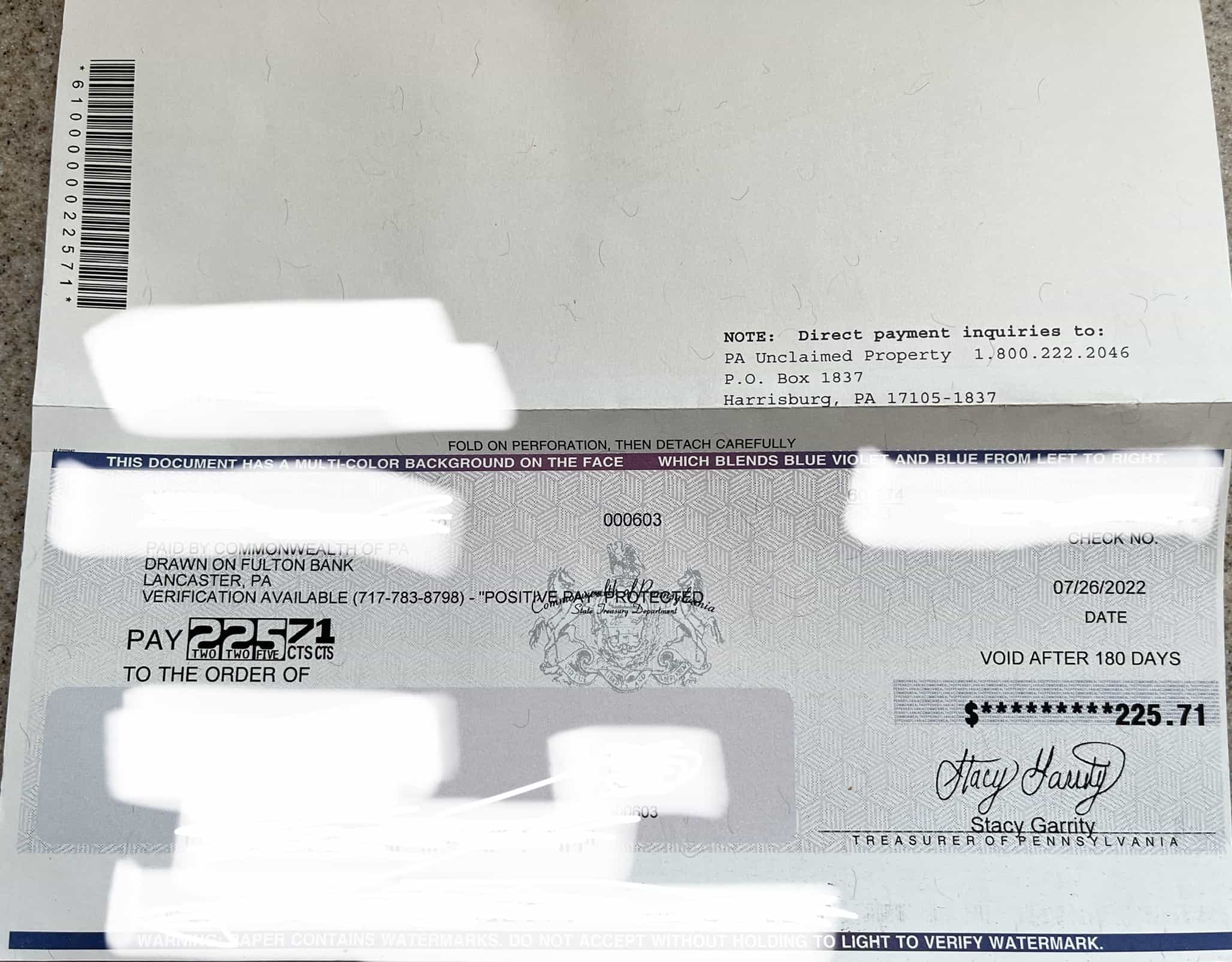

Finally, submit your claim and wait for the state to review it. Depending on the complexity of the case, this process can take anywhere from a few weeks to a few months. But once your claim is approved, you’ll receive your money either by check or direct deposit.

What Happens After You Claim Your Funds?

Once you’ve claimed your unclaimed funds, you’re free to do whatever you want with the money. There are no restrictions or requirements on how you use it. Some people choose to pay off debts, others use it to fund a vacation or home improvement project, and still others simply add it to their savings. The choice is yours!

Common Mistakes to Avoid

While the process of claiming unclaimed funds is relatively straightforward, there are a few common mistakes people make that can delay or even derail their claims. Here are a few to watch out for:

- Not providing all the required documentation. Make sure you have everything you need before submitting your claim.

- Using outdated or incorrect information. Double-check all the details you provide to ensure accuracy.

- Working with third-party companies. As I mentioned earlier, you don’t need to pay anyone to help you claim your unclaimed funds. Stick with the official state resources to avoid scams.

Resources and Tools to Help You Find Your Money

If you’re feeling a little overwhelmed by the process, don’t worry. There are plenty of resources available to help you navigate the world of unclaimed funds. Here are a few you might find useful:

Wisconsin Department of Revenue

The Wisconsin Department of Revenue is your go-to source for information on unclaimed funds. Their website provides a comprehensive database where you can search for your name and see if any matches come up.

National Association of Unclaimed Property Administrators (NAUPA)

NAUPA is a national organization that works to promote the return of unclaimed property to its rightful owners. Their website, unclaimed.org, allows you to search for unclaimed funds in all 50 states, including Wisconsin.

Conclusion: Take Action Today!

There you have it, folks. The state of Wisconsin unclaimed funds is a real opportunity to reclaim money that belongs to you. Whether it’s a few dollars or a few thousand, every little bit helps. So don’t wait—start your search today and see if there’s any hidden treasure with your name on it.

And remember, this isn’t just about finding money. It’s about taking control of your financial future. By claiming your unclaimed funds, you’re making a statement: you’re not going to let forgotten assets slip through the cracks. So get out there, do your research, and make sure you’re getting what’s rightfully yours.

Finally, I’d love to hear from you. Have you ever claimed unclaimed funds in Wisconsin? What was your experience like? Drop a comment below and let’s chat. And if you found this article helpful, be sure to share it with your friends and family. Who knows? You might just help someone else discover their own hidden treasure!

Table of Contents

- What Exactly Are Unclaimed Funds?

- How Do Funds Become Unclaimed?

- Why Should You Care About Unclaimed Funds?

- Why Wisconsin Stands Out in the World of Unclaimed Funds

- The Size of the Problem

- How Wisconsin Handles Unclaimed Funds

- How to Search for Unclaimed Funds in Wisconsin

- Common Types of Unclaimed Funds in Wisconsin

- How to Claim Your Unclaimed Funds

- Common Mistakes to Avoid

- Resources and Tools to Help You Find Your Money

- Conclusion: Take Action Today!

- Renee Rapp Height The Rising Stars Measurements And Beyond

- Heather Dinich Age Unveiling The Life And Career Of Espns Talented Reporter

Unclaimed Funds Revealed Get Started

Unclaimed Funds Archives New York Retirement News

How to Find State Unclaimed Funds